Recently I discovered a PayPower prepaid credit card that allows paying bills. However, this card has a set of restrictions for those payments. It is not an easy task to follow those restrictions. I tried different ways to make it work: paper, spreadsheet…, however, it was not convenient.

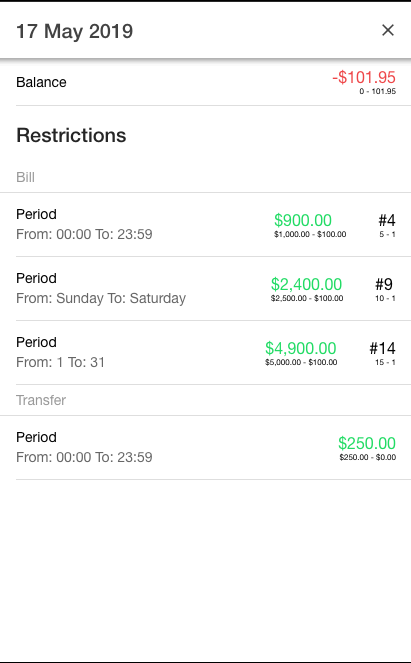

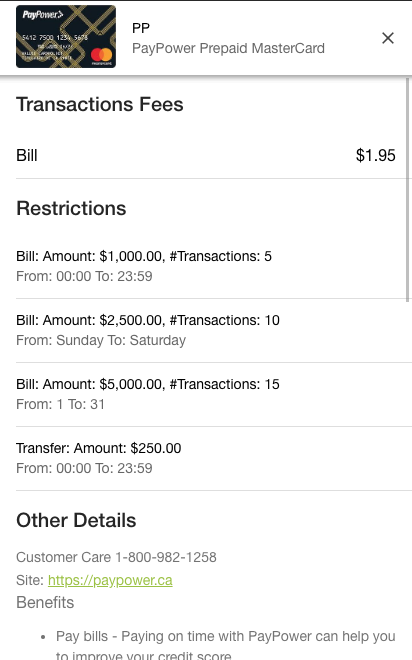

PayPower Bill Payment Restrictions:

| 24 hours (12am-12am EST) | 7 days (Sunday-Saturday) | 30 days | |

|---|---|---|---|

| # of transactions | 5 | 10 | 15 |

| $ amount | $1000 | $2500 | $5000 |

Till I discovered a web application: “Budgific Wallet” that allows tracking cards transactions. In addition, this application provides the ability to plan the spendings and alert if future spending will be restricted. It shows how to match you can spend on a specific type of transaction.

The wallet supports desktop and mobile devices and can work offline and online.

I use this application in this way:

- Register in this application, the registration is required to synchronize the data between your devices. Use the real email, as it sends a verification code to the email.

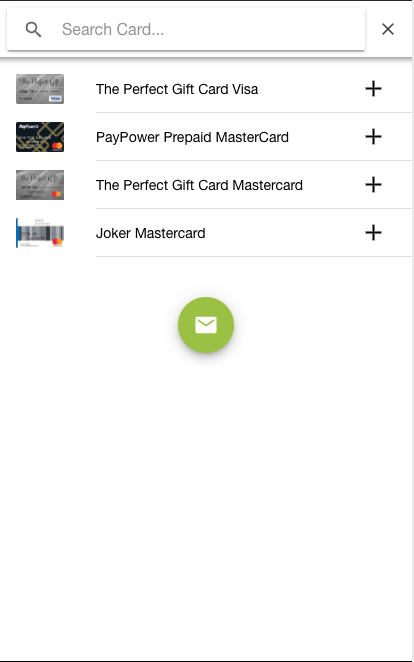

- Add PayPower credit card to your wallet, you should provide a nickname for your card.

Tip: You can ask the developer to add a credit card if you can’t find yours by sending him a message.

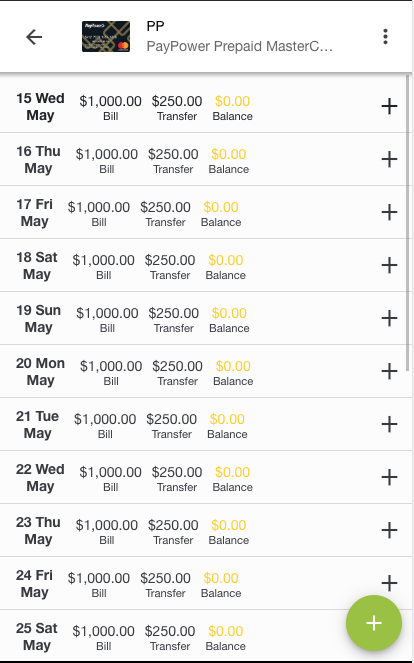

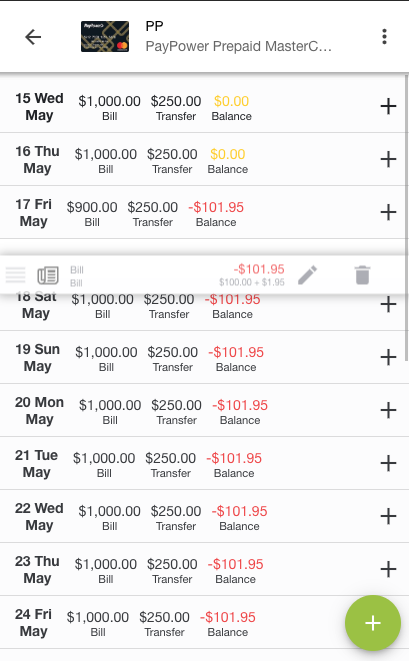

- Add your past transactions for a month back, that you have the real current situation of the card.

Tip: If your current balance zero and you did not have “bill” transactions in the past month, you don’t have to add past transactions.

- You can drag the transaction from a day to another day, to plan the future the spendings.

- You can see the details of the current restrictions.

- You can see the details of the credit card.

This application helped me a lot to not hit restrictions every time when I pay bills.